Professional Academy :

About : Adhyeta Professional Academy

As the leading coaching institute for professional courses in the fields of Finance and Accounting, APA provides training in CA, CMA (USA), ACCA, CMA (India) and CS courses in Bengaluru and has plans to open centres in other cities as well.

Our Methodology

At APA, education imparted to students follows a system that is methodical, in depth and provides conceptual clarity that equips students and emerging professionals with critical thinking and analytical skills as well as thorough, real time and application based knowledge that is integral to improving career prospects and progress professional growth.

We provide a learning environment that employs on-line classroom as well as off-line sessions, seamlessly blending various teaching methods to ensure maximum benefits for students while boosting their enthusiasm for learning. Our team of highly qualified and experienced faculty members serve as mentors and guides to students, providing individual attention and helping them convert their aspirations into achievements.

Courses Offered by Adhyeta Professional Academy

CA

Adhyeta Professional Academy is the best CA coaching Institute in Bangalore. We provide both regular batches in the morning and evening.

ACCA

ACCA Course Coaching in Bangalore – Course Overview.ACCA is short for Associate of Chartered Certified Accountants.

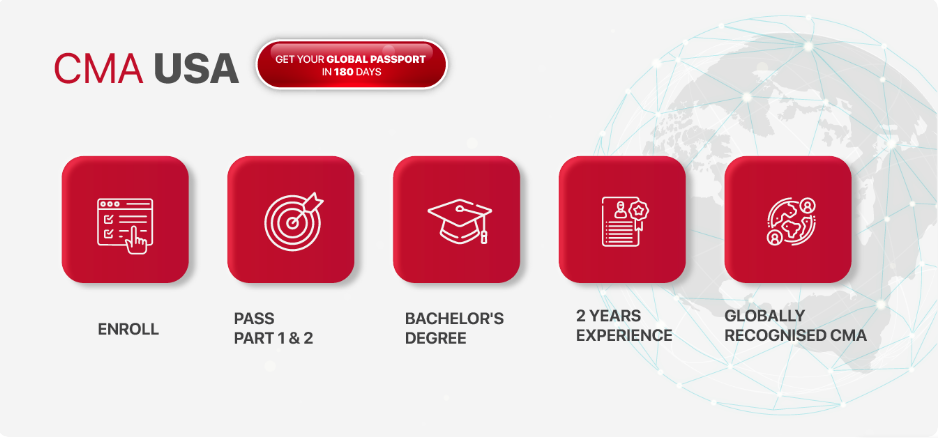

CMA USA

Our student’s trust in our teaching methodology has made us the best CMA USA Coaching in Bangalore.

CA Coaching in Bangalore :

Adhyeta Professional Academy is the best CA coaching Institute in Bangalore. We provide both regular batches in the morning and evening. Work at organizations of all sizes, industries and types, including

- Wide ranging career opportunities in the four core business areas depending on the area of focus.

- CAs may handle one aspect of a company’s business or may oversee all of the company’s accounting needs.

- Work as an independent financial consultant handling multiple client portfolios.

- A Chartered Accountant is the equivalent of a CPA (Chartered Public Accountant) in the USA.

Adhyeta Professional Academy has always been at the top when it comes to placements and that is why we work with 100 of companies wherein we look forward for getting our students placed. We have got our students placed in some of the top corporates in India and the Big 4 and would continue with our commitment to provide better placements for our students.

| Paper 1 | Principles and Practice of Accounting |

|---|---|

| Paper 2 | Business Laws & Business Correspondence and Reporting Section A: Business Laws Section Section B: Business Correspondence and Reporting |

| Paper 3 | Business Mathematics and Logical Reasoning &Statistics Part I: Business Mathematics and Logical Reasoning Part II: Statistics |

| Paper 4 | Business Economics & Business and Commercial Knowledge Part I: Business Economics Part II: Business and Commercial Knowledge |

The IPCC or the CA Intermediate course is the next level in the process of acquiring a Chartered Accountancy qualification and may be taken after completion of the CA Foundation level, we are best CA coaching in Bangalore.

| CA Intermediate – Group I | |

|---|---|

| Paper 1 | Accounting |

| Paper 2 | Corporate & Other Laws Part I : Corporate Law Part I : Other Laws |

| Paper 3 | Cost and Management Accounting |

| Paper 4 | Taxation Section A: Income-tax Law Section B: Indirect Taxes |

| CA Intermediate – Group II | |

| Paper 5 | Advanced Accounting |

| Paper 6 | Auditing and Assurance |

| Paper 7 | Enterprise Information Systems & Strategic Management Section A: Enterprise Information Systems Section B: Strategic Management |

| Paper 8 | Financial Management & Economics for Finance Section A: Financial Management Section B: Economics for Finance |

As the final stage of acquiring a Chartered Accountancy qualification, one needs to get the right coaching at the best CA Coaching in Bangalore. The CA Final comprises of 8 subjects divided in 2 Groups with 4 subjects each. APA provide best CA coaching in Bangalore.

| CA Final – Group I | |

|---|---|

| Paper 1 | Financial Reporting |

| Paper 2 | Strategic Financial Management |

| Paper 3 | Advanced Auditing and Professional Ethics |

| Paper 4 | Corporate and Economic Laws Part I: Corporate Laws Part II: Economic Laws |

| CA Final – Group II | |

| Paper 5 | Strategic Cost Management and Performance Evaluation |

| Paper 6 | Elective Paper (One to be chosen from the list of Elective Papers) 6A – Risk Management 6B – Financial Services & Capital Markets 6C – International Taxation 6D – Economic Laws 6E – Global Financial Reporting Standards 6F – Multi-disciplinary Case Study |

| Paper 7 | Direct Tax Laws & International Taxation Part I: Direct Tax Laws Part II: International Taxation |

| Paper 8 | Indirect Tax Laws Part I: Goods and Services Tax Part II: Customs & FTP |